How Lightning Network can Change the World

Lightning Takes Bitcoin from Digital Gold to Universal Money

As amazing as El Salvador’s new Bitcoin Law has been, I’d argue the most under-reported story of the past year isn’t El Salvador, it’s the exponential rise of the Lightning Network.

Beyond Lightning making El Salvador’s law possible in the first place, and beyond Lightning rendering obsolete the “faster, cheaper” altcoin clone army, the Lightning Network is now moving Bitcoin exponentially closer to becoming a true universal medium of exchange that is controlled by the people, not by governments.

Lightning Network “In the Wild”

I spent the last week at the Bitcoin Lounge nestled cozily amid the Free State Project’s annual Porcfest in New Hampshire — named for the Porcupine, the libertarian mascot, and located just 7 miles from the infamous Bretton Woods as the crow flies.

I came away feeling like I’d seen the future. One where the Bitcoin ecosystem is technologically ready to become the world’s universal money, and possibly far more.

As we enjoyed the mild New Hampshire summer, people wandered over to buy $2 sodas with Bitcoin, paying instantly and with zero transaction fee. I watched patient bitcoiners onboard Lightning newbies, taking them from zero to a Lightning wallet full of fresh hot sats in literally 5 minutes. It was the iconic “buy a coffee with Bitcoin” on steroids.

In fact, we all goofed around with Lightning, sending sats around the table round-robin. Jim whipped out a stack of Venezuelan Bolivars, which we briefly considered trading until Joe reminded us there is no durable buy-side. Plus, the largest Venezuelan bill we had is only worth 1/20 a satoshi. Tone finally pulled up with a mountain of top sirloin for the grill, bring to a close the first prospective Venezuelan Bolivar market north of Caracas.

It’s worth noting that we were using bluewallet to trade dollars for sats, but we’d have happily used Strike – the app building out El Salvador’s infrastructure -- save for the fact that Strike is quasi-banned by US regulators who, presumably, are more interested in helping bankers than in helping the American people.

Lightning’s Exponential Dawn

It was on-the-ground confirmation of what the statistics are already saying: the Lightning Network has arrived. Confirmation that the Bitcoin developer ecosystem has now built the holy grail: Bitcoin as a true medium of exchange. One where transfers are instant, essentially free, and as easy to use as the simplest app on your phone, whether Uber, Venmo, or Twitter.

In fact, our sats party replicated what’s now going on across the world. Just last week at El Salvador’s now-famous Bitcoin Beach, 20,000 near-instant transactions went around with aggregate fees of $4.98. One-fortieth of a penny per transaction. For perspective, that’s about 500 times cheaper than the credit card fee on a $5 cappucino, and it’s at least 4,000 times cheaper than the average credit card transaction fee.

Note, 1/40 of a penny would cover essentially any amount — you could buy a house with Lightning for 1/40 penny. It transfers instantly, 24/7 including holidays, and is able to leap national borders and regulatory gatekeepers with zero effort. Try all that with your visa card.

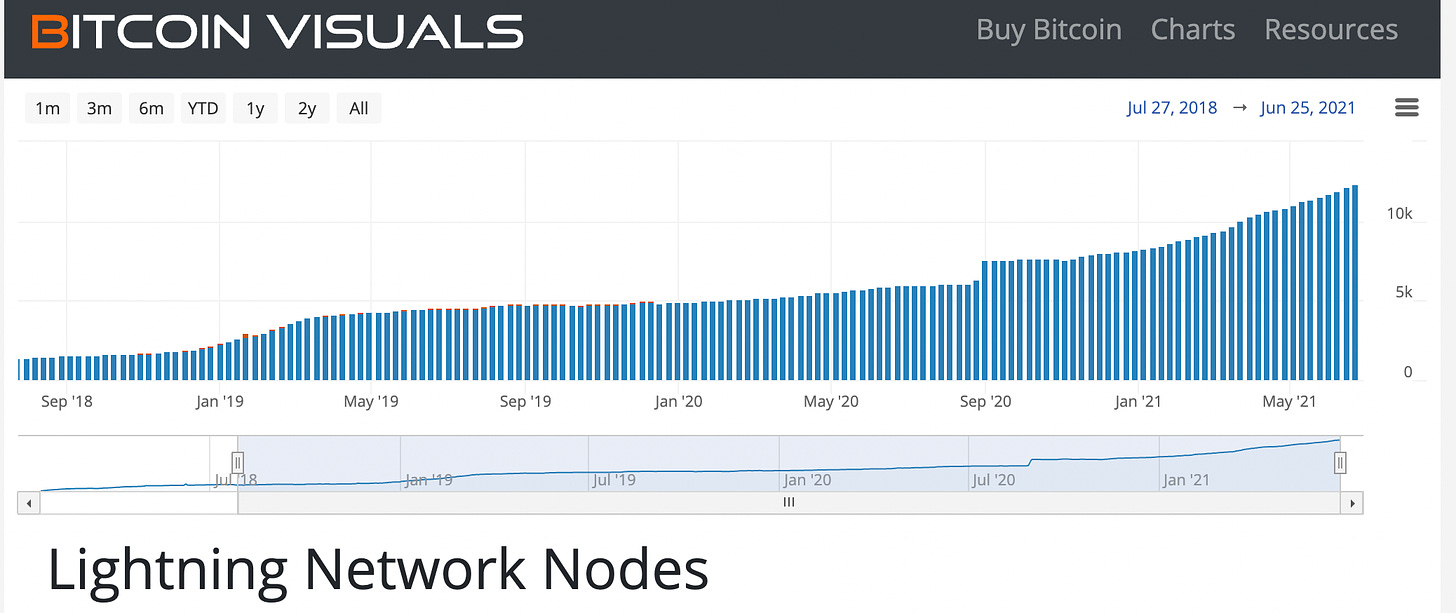

These aren’t just anomalies; Lightning Network statistics have exploded since May, with network capacity now expanding by an annualized 635%. As these new Lightning apps onboard millions of people, they then pass along and train newbies by word-of-mouth, creating exponential growth that can very quickly go from irrelevant to dominant. Inventor Ray Kurzweil once said “in any exponential process, 1% is half-way there.” Lightning Network has hit the exponential zone.

It’s worth noting that we’ve all been waiting some time for this. The original Lightning Network White Paper came out in 2015, and after heady growth through 2019, the Network was essentially moribund these past 2 years. I imagine the slow going was because user interfaces simply weren’t there yet for most users. But now, apparently, they are.

Lightning and Altcoins

Beyond enabling reforms like El Salvador’s Bitcoin Law, Lightning Network’s growth changes the game for Bitcoin in three ways.

First, it knocks the legs out of competing “medium of exchange” (MOE) coins like Dogecoin, Bcash, Ripple, Litecoin, or their many knock-offs. Bitcoin’s government-resistance has always made it the only choice for protecting long-term savings. But Bitcoin’s fees and speeds meant that there remained a niche for MOE coins, for the same reason you buy pesos when you visit Mexico even as you keep your savings back home in dollars.

In fact, just a few months ago I wrote about this niche, how Dogecoin and similar MOE coins might be fun for a specific transaction, but they don’t compete with Bitcoin since you’d never want to park your savings in them. But now, I’d revise that and say Lightning now means MOE coins have no purpose whatsoever beyond pure gambling — cryptokitties that aren’t even pretty to look at.

Lightning and Hyperbitcoinization

The second game-changer is that Lightning’s growth radically improves Bitcoin’s odds of becoming a true daily-use currency. Hyperbitcoinization. After all, money itself has only two purposes: saving and transactions. Bitcoin’s disinflationary supply schedule had long made it superior to USD for savings, but if Lightning now means Bitcoin is also superior for transactions, that’s the whole enchilada for money. At that point, fiat is coasting on fumes and it’s only a matter of time and bureaucratic foot-dragging until hyperbitcoinization.

Of course, hyperbitcoinization won’t happen overnight for a number of reasons: installed base, complimentary services and skill-sets, customer familiarity and training, regulations, the drumbeat of nocoiner FUD that throws psychological barriers at the very people Bitcoin could most help, and the volatility that all of that brings. Still, if Bitcoin now beats fiat for buying a coffee, it is a very different game with a faster timeline, higher stakes, and a much easier onramp.

Of course, don’t expect any recognition or even acknowledgment from Bitcoin critics, who have long displayed a singular failure to grasp the most basic aspects of Bitcoin. They will keep up the same tired criticisms they’ve been recycling for a decade now. Partly because they’re lazy, and partly because, as Upton Sinclair put it, “It is difficult to get a man to understand something when his salary depends on his not understanding it.”

Lightning and Decentralized Services

The third reason Lightning changes the game is yet bigger. Just as the internet needed user-friendly interfaces (web browsers) before it could really change the world, Bitcoin needed user-friendly interfaces to grow beyond money and towards being the base layer — the “rails” — for decentralized services built on Bitcoin alone.

These can include genuinely free speech platforms that cannot be censored. Or government-proof Silk Roads where regular people can buy and sell without begging for a bureaucrat’s permission. It could even open a path for people to escape totalitarian regimes, as is currently happening in Hong Kong. It goes without saying that all of these may become increasingly important — even necessary — given current trends.

Conclusion

And so, beyond the $80 trillion fiat question, beyond the tens of millions of new Bitcoin users and the groveling politicians they bring, Lightning Network could ultimately restore the balance between the sovereign people and the bureaucrats who allegedly serve them. A world where politicians and bureaucrats are certainly free to have opinions, and we the people are equally free to ignore them.

Thanks for reading, and subscribe for weekly updates. See you next time!

> Note, 1/40 of a penny would cover essentially any amount — you could buy a house with Lightning for 1/40 penny.

This is factually incorrect. Lightning fees have two components, the base fee (it's often zero to make future pathfinding algorithms work better but the default is 1 sat) and the ppm (parts per million). The total fee would be base_fee+amount*fee_ppm/1000000. So no, you'll pay a significant fee for such a transaction but most importantly there's simply not enough liquidity and no good splitting algorithms currently to move hundreds of thousands dollars. LN is for small and fast payments, on-chain is for big and slow ones. They complement each other, not replace. To buy a car or a house an on-chain payment with a fixed fee would be most optimal. You pay for block space on-chain (and that space doesn't depend on the amount) and in LN you pay for using liquidity (which depends on the amount).

Besides, if you use BlueWallet with their LndHub and you send money to someone else who also uses BW with their LndHub you don't even use Lightning. They just correct your balances because LndHub is a custodial service that manages user accounts. You can install it on your own node and use it with BW (I do that for example!) but if it's among the same hub users the money doesn't move at all. Because of that of course the payments would be completely free and instant.